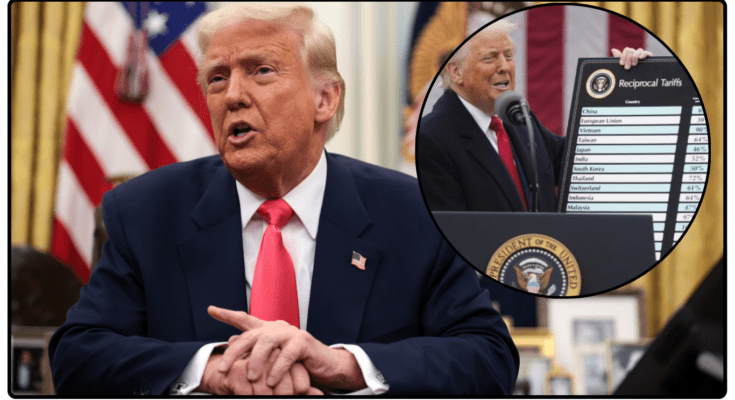

When former President Donald Trump says something about the economy, people listen—especially investors. Recently, he made headlines with a surprising statement: “I don’t want stocks to go down… but sometimes you have to take medicine.” If you’re scratching your head about what that means for your 401(k), savings, or the economy, you’re not alone. Let’s break down Trump’s cryptic comment, why leaders might let stocks dip on purpose, and how this “medicine” could affect everyday Americans.

What Did Trump Mean by “Taking Medicine” for the Economy?

First, some context. Trump has always tied his political brand to a strong stock market. During his presidency, he frequently tweeted about record highs, framing them as proof of his policies working. So why would he suddenly say markets might need to “take medicine” (a.k.a. suffer short-term losses)?

Experts think he’s hinting at a classic economic dilemma: short-term pain for long-term gain. Imagine you’re sick with a fever. Medicine might make you feel worse at first (hello, side effects), but it’s necessary to heal. Similarly, tough policies—like raising interest rates or cutting spending—can hurt stocks temporarily but prevent bigger disasters like hyperinflation or a debt crisis.

Key Takeaway: Even pro-growth leaders like Trump know you can’t always avoid economic bandaids.

When Have Leaders “Treated” the Economy Before?

History shows that “taking medicine” isn’t new. Let’s look at two examples:

-

- Paul Volcker’s Inflation Fight (1980s):

The Federal Reserve chair jacked up interest rates to 20% to kill runaway inflation. Stocks plunged, businesses folded, and unemployment spiked—but it worked. Inflation dropped from 14% to 3%, setting up the 90s boom. - 2008 Financial Crisis Bailouts:

The government spent billions bailing out banks and automakers. Stocks tanked, and taxpayers were furious, but it saved the economy from total collapse.

- Paul Volcker’s Inflation Fight (1980s):

@abcnews Pres. Trump said “it’s going very well” after stocks plummeted in the wake of his sweeping tariffs announcement. “The markets are going to boom, the stock is going to boom, the country’s going to boom,” Trump told reporters as he left the White House on Thursday for Miami. The Dow slid nearly 4% by the closing bell Thursday, while the tech-heavy Nasdaq declined almost 6%. #trump #stocks #tariffs #economy #news #abcnews

Trump’s own “medicine” included tariffs on China in 2018. Stocks wobbled, but he argued it was needed to fix unfair trade deals.

Why Would Trump Let Stocks Drop Now?

Trump hasn’t detailed specific policies yet, but here’s what experts speculate:

- Taming Inflation: If elected, he might support aggressive Fed rate hikes to cool prices, even if it hurts markets.

- Debt Reduction: Cutting government spending could spook investors reliant on stimulus but prevent a debt meltdown.

- Trade Wars 2.0: New tariffs or anti-China moves might disrupt supply chains, hitting corporate profits short-term.

The Big Question: Would Trump prioritize long-term stability over the market’s daily highs? His past suggests maybe—if he can frame it as “winning.”

How “Economic Medicine” Hits Everyday Americans

You don’t need a Wall Street job to feel this. Here’s how Trump’s “medicine” could play out:

- Retirement Accounts Take a Hit:

If stocks dip, your 401(k) or IRA loses value. Retirees withdrawing funds could suffer most. - Mortgage Rates Stay High:

Fighting inflation often means higher interest rates. Buying a home? Expect pricier loans. - Job Market Jitters:

Companies might freeze hiring or lay off workers if borrowing costs rise. - Everyday Prices Might Drop… Eventually:

The goal of “medicine” is to stabilize prices. But groceries and gas could stay painful for months first.

What Investors Should Do to Prep

Trump’s warning is a wake-up call: Don’t assume stocks only go up. Here’s how to protect your money:

- Diversify, Diversify, Diversify: Spread investments across stocks, bonds, real estate, and cash.

- Avoid Panic Selling: Markets bounce back. Selling low locks in losses.

- Watch for Safe Havens: Gold, Treasury bonds, and even Bitcoin often rise when stocks fall.

- Stay Informed: Follow Fed policies and election updates. Politics moves markets.

Pro Tip: If you’re retired, keep 2-3 years of expenses in cash. That way, you won’t sell stocks during a slump.

What Trump’s Critics and Supporters Are Saying

- Critics: They argue Trump’s past policies (tax cuts, stimulus) boosted stocks short-term but added $8 trillion to the national debt. “Medicine” now could mean cleaning up his own mess.

- Supporters: They claim Trump’s willing to make tough calls others avoid. Letting stocks dip shows he’s serious about long-term growth.

Middle Ground Take: All presidents face the “medicine” dilemma. The real test is whether they’re honest about trade-offs.

Could Trump’s Warning Actually Help the Market?

Paradoxically, yes. Here’s why:

- Realistic Expectations: If investors know a downturn is coming, they won’t panic as much when it happens.

- Trust in Strategy: Markets hate uncertainty. A clear plan (even a painful one) can stabilize things faster.

Example: In 2020, the Fed warned of a COVID-induced recession early. Stocks crashed but rebounded quicker because everyone was prepared.

The Bottom Line: Should You Worry?

Trump’s statement isn’t a doom prophecy—it’s a reality check. Healthy economies can’t grow forever without corrections. Here’s your action plan:

- Don’t Check Your Portfolio Daily: Long-term investing wins.

- Focus on Fundamentals: Jobs, inflation, and corporate profits matter more than presidential tweets.

- Vote with Your Wallet: Literally. Elections shape policies, so research candidates’ economic plans.

Keywords for Success: Trump stock market, economic medicine, stock market correction, investing during inflation, Fed rate hikes, diversify investments, election impact on economy, long-term economic growth, short-term market loss, protect retirement savings.

2 Comments on “Trump’s Stock Market Warning Sometimes You Have to Take Medicine | What It Means for Your Wallet”