The tech-heavy Nasdaq Composite index fell into a bear market, overshadowing some good news about the U.S. labor market. President Trump insisted his policies were working.

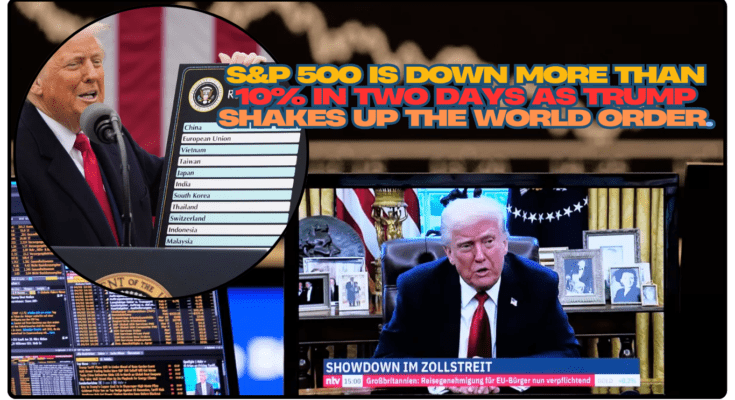

The S&P 500 dropped more than 10 percent in two days and the tech-heavy Nasdaq Composite Index closed in a bear market on Friday, capping one of Wall Street’s worst weeks since the start of the coronavirus pandemic in 2020.

The U.S. rout followed losses in global markets. China launched a counterattack against Mr. Trump’s policies, which impose steep taxes on all American goods to match Mr. As part of his broad tariffs on America’s trading partners, Trump had made announcements this week regarding Chinese goods. Later, after a report showing a solid pace of hiring at U.S. employers, the president said that China’s retaliation was misguided and that his trade policy was effective in bolstering the economy.

@msnbc President Trump told reporters he expects his sweeping tariffs on nearly all U.S. imports will cause the country and its stock markets to “boom,” despite global and domestic markets plummeting in reaction. #trump #markets #politics #news

Here’s what else to know:

Widespread market losses: The S&P 500 fell 6 percent by the end of trading on Friday, inching closer to a bear market, Wall Street’s term for a decline of more than 20 percent from its latest peak, reached in mid-February.

5.8% of the Nasdaq Composite index went down. China retaliates:

Beijing’s Finance Ministry said it would impose 34 percent tariffs on all U.S. products. The Commerce Ministry also said it was barring 11 American companies from doing business in China, and customs authorities said that they would halt chicken imports from five of America’s biggest agricultural exporters.

Oil prices are falling as a result of concerns that the turmoil in the trade war could reduce demand for oil and other commodities. China’s retaliatory tariffs have further fueled these concerns. On Friday, the international benchmark for crude oil, Brent, was at its lowest point in more than three years.

Data on employment in the United States:

The Labor Department reported that employers created 228,000 new jobs in February, which was significantly more than was anticipated and was up from the revised total of 117,000 in February. KPMG’s chief economist, Diane Swonk, stated that she was “pleasantly surprised” by the data, but that the impending effects of the Trump administration’s federal job cuts and tariffs indicate that “this is likely to be the high point.” Warnings about higher inflation: Jerome H. The Federal Reserve’s Powell issued a warning that Mr. As he became more pessimistic regarding the economic outlook for the United States, Trump’s tariffs ran the risk of stoking even higher inflation and slower growth than was initially anticipated.

Trump responds: Despite the fact that the jobs data covered a period prior to Mr. When Trump’s global tariffs went into effect, he was overjoyed by the numbers and wrote on Truth Social, “GREAT JOB NUMBERS, FAR BETTER THAN EXPECTED.” It already functions. He also lashed out at Beijing’s countermeasures, saying China had “PLAYED IT WRONG” and “PANICKED.”