Hello, future entrepreneurs! Are you planning to form your LLC (Limited Liability Company) and you ask yourself how much business insurance will be necessary? Welcome to our site! In this article, we’ll discuss business insurance for an LLC and the different options available so that you can make a proper decision for your business. To make it more accessible, this guide is meant for 8th and 9th graders so advanced knowledge is not overcomplicated but all the relevant information.

Why an LLC Needs Business Insurance

Insurance is just like a superhero has a shield, business insurance has a shield for your company in case of any mishap. Right cover produces financial stability and growth because it tackles the amounts that will affect the companies or individuals’ cash flows. The key types of business insurance for an LLC include:

– General Liability Insurance: Covers your business against legal action involving property and physical injury or unintentional personal injury to third parties.

– Property Insurance: Protects your business property against loss through destruction, theft or vandalism.

– Workers’ Compensation: Makes certain employees get compensation if they get injured while working.

Knowing these insurances are potential to save a lot of money in a way that will reduce possible risks.

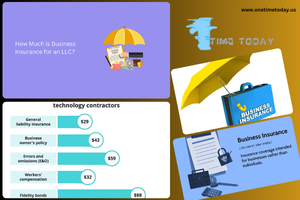

The Cost of Business Insurance for an LLC

Business insurance prices depend on issues such as type of business, location, revenue, and size. Normally LLCs spend about 500- $2000 every year to cover a general liability insurance. The cost of your property insurance depends on your location and the value of your property. For example, a commercial building in a high-risk zone will require more premium that a small warehouse in a low-risk zone.

In order to obtain an accurate insurance cost it is advisable to contact an insurance agent to give a cost that will suit your business.

Cost Influences of Business Insurance

To calculate the insurance premium, your insurance provider will consider:

1. Industry: Your insurance cost is also greatly influenced by your business sector. Some occupations, such as construction or transport, will probably attract higher premiums.

2. Claims History: Fewer claims will be paid for in premium in comparison to the businesses that make multiple claims to the insurance company.

3. Location: The cost might be higher where companies are located like disaster prone, high crime rate or areas of usually accidents.

4. Revenue: Also, many high revenue business will have high insurance premiums but this may not be the case.

5. Employees: Workers compensation insurance is expensive and if you have many number of employees, you will need high number of insurance expenses.

Tips How to Minimize Business Insurance Expenses

It important to understand that it’s possible to both curb and improve insurance expenses while not compromising on coverage. Here are a few suggestions:

1. Be selective with the insurance you choose and make sure you only acquire what is critical.

2. Always check up on your policy now and then and make changes as your business expands or changes.

3. You should discuss options to raise the amount of deductible to decrease premium amounts.

4. Discount is offered for people who combines two or more insurance policies such as the general liability insurance and property insurance from the same insurance company.

Conclusion

In conclusion, Business insurance is very important to all the LLC to keep your investment and financial security safe. With the insurance you require for your business and the necessary actions you take to minimize your insurance costs, your business can receive the protective cover you desire without spending too much money. Having learned all this, you are more equipped to make the right decision of insurance for you LLC. Happy entrepreneurship!